- The Irrelevant Investor

- Posts

- Animal Spirits: Inflation or Price Gouging?

Animal Spirits: Inflation or Price Gouging?

PRESENTED BY MOBY: Global Liquidity Hits Record Highs of Nearly $175 Trillion

Global liquidity is on the rise. Last week, it slowly climbed $1.13 trillion, pushing the total to an unprecedented $174.67 trillion, marking a new all-time high. This influx of capital into the global financial system indicates an overall increase in access to capital across international markets and an approving nod for risk-on assets, including equities and high-yield bonds.

With more capital available, global markets could see some momentum in stock markets, especially in sectors sensitive to economic growth, which bodes well for the U.S. and global economies as increased liquidity can fuel economic expansion and boost investor confidence.

If global liquidity continues to rise, financial markets may strengthen further, with equities likely continuing their upward trajectory. A persistent increase in liquidity would likely lead to lower borrowing costs and stimulate economic activity, but it would also raise concerns about asset bubbles and financial stability.

The Financial Times predicted this back in January 2024, stating, “Q.T. was partly offset by the Fed’s emergency Bank Term Funding Program that offered loans to banks in the wake of the collapse of Silicon Valley Bank.

Get the full insights into how global liquidity highs might affect the future portfolio management with Moby.

Get the full insights into how global liquidity highs might affect the future portfolio management with Moby. Click here to learn more

Today's Animal Spirits is brought to you by Eaton Vance:

See here for more information on Eaton Vance's suite of ETFs

On today’s show, we discuss:

Listen here:

Recommendations:

Charts:

Tweets:

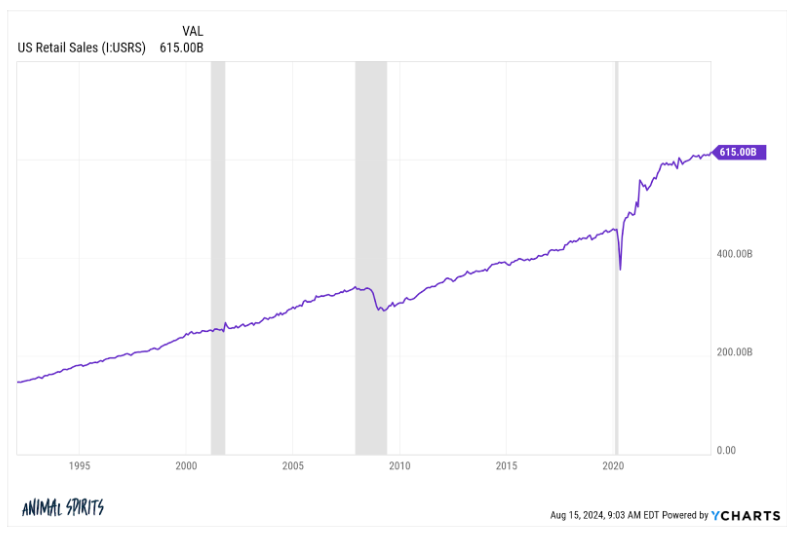

Retail sales above expectations at 0.4% gain overall, with control group up 0.3% and jobless claims below expectations at 227K. Continuing claims a bit lower.

— Kathy Jones (@KathyJones)

12:31 PM • Aug 15, 2024

Layoffs rate is extremely low

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

11:30 AM • Aug 19, 2024

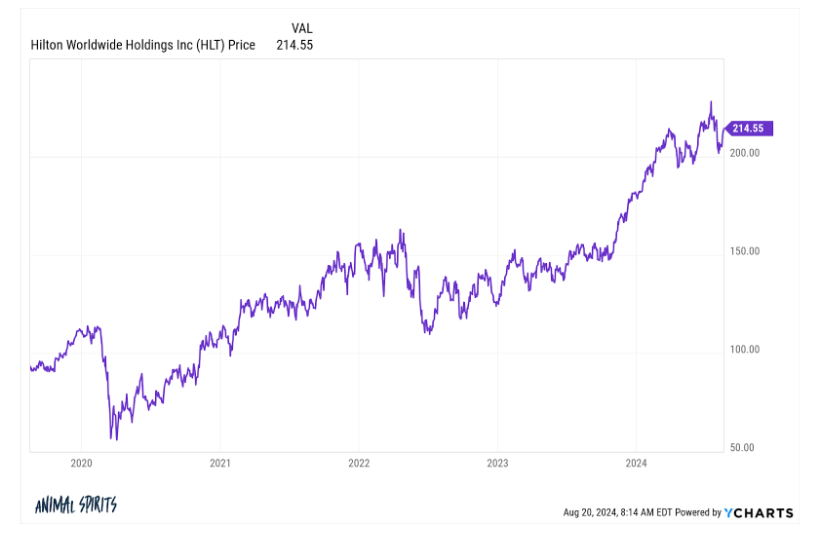

APOLLO: “.. retail sales are strong, jobless claims are falling, restaurant bookings are strong, air travel is strong, hotel occupancy rates are high, bank credit growth is accelerating, bankruptcy filings are trending lower, credit card spending is solid, and Broadway show… x.com/i/web/status/1…

— Carl Quintanilla (@carlquintanilla)

2:04 PM • Aug 17, 2024

Core CPI inflation (which excludes volatile food and energy) was moderate for the third straight month in a row in July. At an annual rate:

1 month: 2.0%

3 months: 1.6%

6 months: 2.8%

12 months: 3.2%— Jason Furman (@jasonfurman)

12:42 PM • Aug 14, 2024

The last 12 inflation readings:

2.89%

2.97%

3.27%

3.36%

3.48%

3.15%

3.09%

3.35%

3.14%

3.24%

3.70%

3.67%At the very least the volatility of price levels has subsided

— Ben Carlson (@awealthofcs)

1:17 PM • Aug 14, 2024

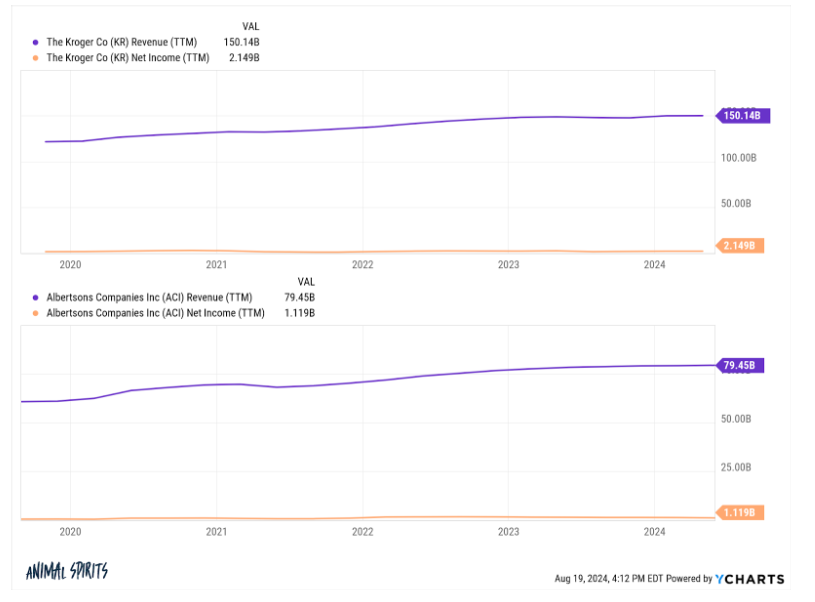

Food company profit increases since inflation peaked:

Cheesecake Factory +471%

Cal-Maine +268%

Jack In The Box +213%

Chipotle +110%

Starbucks +47%

Sysco +43%How much did they collectively spend on stock buybacks? Over $10 billion.

They used inflation as cover to get rich.

— Robert Reich (@RBReich)

8:00 PM • Aug 16, 2024

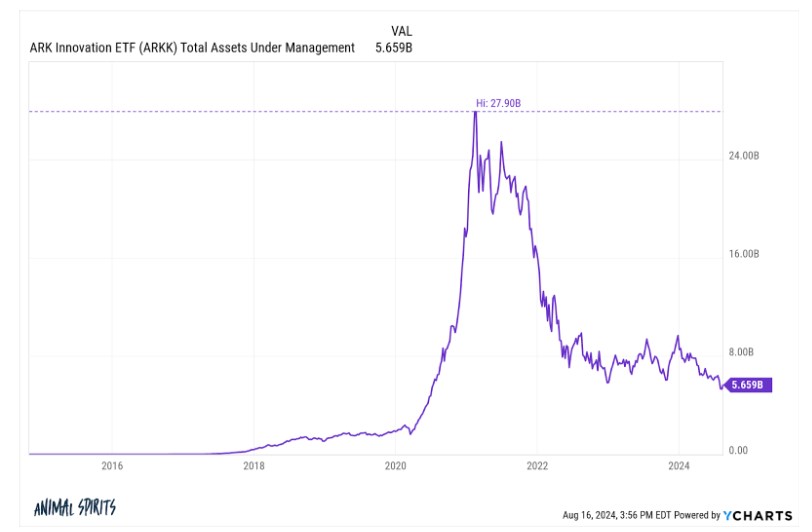

From ARKK's 10/31/14 incept through 1/31/24 (date of its most recent semi-annual report), the fund had collected ~$362.7MM in fees, cumulative. Over this period, the fund had lost ~$7.5B cumulative.

— Jeffrey Ptak (@syouth1)

8:55 PM • Aug 15, 2024

Some people are very disturbed over how we sent our daughter to sleepaway camp for 7 weeks. Let’s hit the basics:

- Camp is the ultimate playground for kids, where they make lifelong friends and grow as humans.

- It is a privilege, not a punishment.

- We missed her way more… x.com/i/web/status/1…

— Heather Joelle Boneparth (@averagejoelle)

1:17 PM • Aug 17, 2024

Saved by the Bell premiered this day in 1989.

It was the first time many people had seen a cell phone.

Roughly 1% of Americans had one at the time.

It cost thousands of dollars.

It took 10 hours to charge.

And the battery lasted for 30 minutes.

— Jon Erlichman (@JonErlichman)

11:18 AM • Aug 20, 2024

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.