- The Irrelevant Investor

- Posts

- Animal Spirits: Fast Food Inflation

Animal Spirits: Fast Food Inflation

Today's Animal Spirits is brought to you by YCharts and CME Group:

See here for 20% off (new customers only) and for more info on YCharts’ Top 10 Visuals Resource Deck!

See here for more information on CME Group's valuable educational materials and trading tools and learn more about what adding futures can do for you.

On today’s show, we discuss:

Listen here:

Recommendations:

Charts:

Tweets:

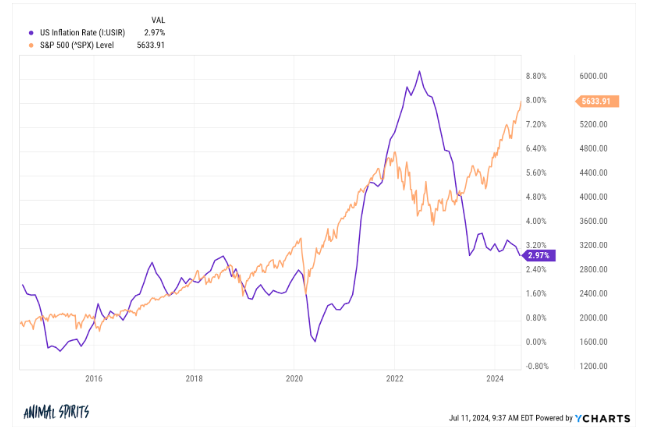

US core inflation ex shelter – has now been negative two months in a row (M-o-M %) – see chart.

Last happened in the pandemic – otherwise not since Dec 2014/Jan 2015

V rare

— Longview Economics (@Lvieweconomics)

12:40 PM • Jul 11, 2024

Chicken wing prices, +190% on the 2yr stack, continue to climb after troughing in late 2022

— Mike Zaccardi, CFA, CMT 🍖 (@MikeZaccardi)

10:25 AM • Jul 16, 2024

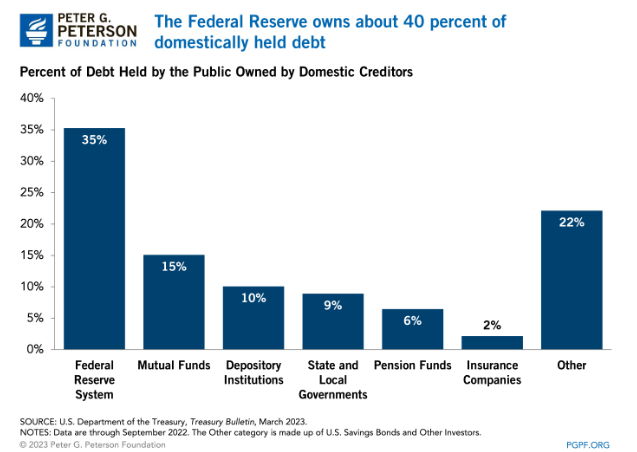

so: $892 billion in risk-free interest income largely going into the pockets to US households, investors & institutions, pension funds, the Fed, the govt itself ("intragovermental debt"), state & local governments + some of our closest foreign allies

and now at higher yields wow

— talmon joseph smith (@talmonsmith)

1:19 PM • Jul 8, 2024

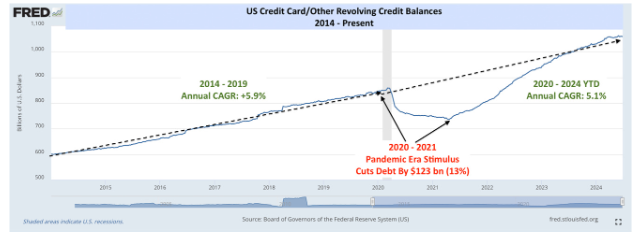

The "credit card doom" narrative suffered a major blow this morning

Serious credit card delinquencies are down for all three major banks that reported today

— Jack Farley (@JackFarley96)

3:53 PM • Jul 12, 2024

A Cybertruck sold for *$262,500* at auction just a couple months ago…

Here’s how much they’re going for now:

@GeorgeJSaliba

— Car Dealership Guy (@GuyDealership)

6:13 PM • Jun 26, 2024

Bitcoin had 20% drawdown in a month flat. Pretty nasty. I would have been impressed if 90% of aum hung in there but it was over 100% as they saw inflows. The Boomers hung tough, even tougher than I predicted, and kept the all imp YTD net number at +$15b. Hanging tough during… x.com/i/web/status/1…

— Eric Balchunas (@EricBalchunas)

3:43 PM • Jul 9, 2024

the Bitcoin ETFs are in "two steps forward" mode after one step back in June with another +$300m yesterday and $1b for week. YTD net total (the most imp number in all this) has crossed +$16b for first time. Our est for first 12mo was $12-15b so already cleared that w 6mo to go.

— Eric Balchunas (@EricBalchunas)

12:21 PM • Jul 16, 2024

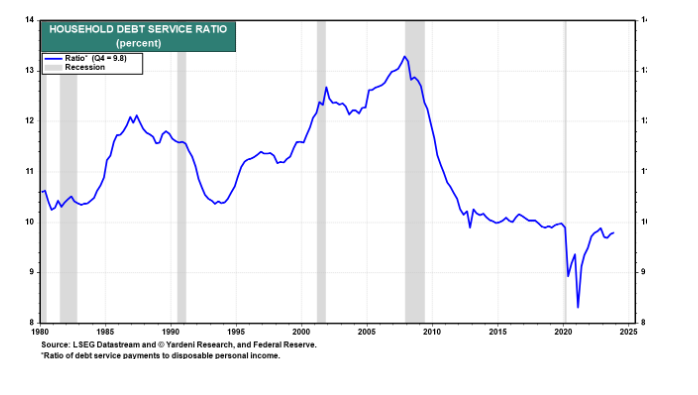

American mortgage holders carry only 48% loan-to-value on their homes, down from 70% a decade ago.

It's really hard to overstate how strong a financial position American homeowners have.

housingwire.com/articles/the-f…

— Mike Simonsen 🐉 (@mikesimonsen)

10:24 PM • Jul 10, 2024

CIO Chart of the Week: As consumers gear up for Prime Day, we are reminded of the increasing efficiency and accessibility with which goods are delivered today. In the last 5 years, the average retailer has cut its “click-to-door” speed by nearly 3 days! Amazingly, Amazon has… x.com/i/web/status/1…

— Rick Rieder (@RickRieder)

5:41 PM • Jul 15, 2024

Contact us at [email protected] with any feedback, recommendations, or questions.

Check out our t-shirts, coffee mugs, and other swag here.

Subscribe here:

Nothing in this blog constitutes investment advice, performance data or any recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. Any mention of a particular security and related performance data is not a recommendation to buy or sell that security. Any opinions expressed herein do not constitute or imply endorsement, sponsorship, or recommendation by Ritholtz Wealth Management or its employees.

The Compound Media, an affiliate of Ritholtz Wealth Management, received compensation from the sponsor of this advertisement. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investing in speculative securities involves the risk of loss. Nothing on this website should be construed as, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy or hold, an interest in any security or investment product.